Just a few of our stories

Why Get Critical Illness?

Why get Critical Illness Coverage?

Do you or a family member have diabetes or high blood pressure? Does anyone in your family have a history of having a stroke or heart attack? Cancer? Then we need to talk. One of the most devastating events for a family is when the primary bread winner or one of the bread winners in our two-income society can’t work due to a heart attack, stroke, or cancer diagnosis. As if that isn’t bad enough not all medical bills are covered by healthcare insurance which can lead to financial ruin. And it’s not just about paying medical bills....what about the income they brought in to pay the bills???

History and physicals are typically used to guide a provider in making diagnosis and treatment plans. I use them to evaluate the types of coverage that would protect my clients from financial struggles due to critical illness or the potential for it. So back to my question, do you or your spouse or a family member have diabetes, high blood pressure, or cancer in the family?

Let me share some scary facts with you. Diabetes and high blood pressure are known to increase your risk for stroke or heart attack. General risk factors for cancer include older age, a personal or family history of cancer, using tobacco products, obesity, alcohol, some types of viral infections, such as human papillomavirus (HPV) and specific chemicals. What would happen to you, your family or your business if you suffered any of these conditions and the medical bills began to mount up? What would happen if the normal family routine was completely disrupted because a key person is unable to fulfil their role like taking the kids to school, taking care of the kids, running the business? Do you have an emergency fund to fall back on? The answer from many of my clients is no. That is why I recommend a critical illness policy.

What does a critical illness policy do you might ask? In the event of a big health emergency, such as cancer, heart attack, or stroke critical illness coverage will pay a lump sum to up to $100,000 to pay medical bills, pay for childcare, or whatever area of your life is suffering the most from this catastrophic event. This type of coverage also has an option to cover a recurrence event.

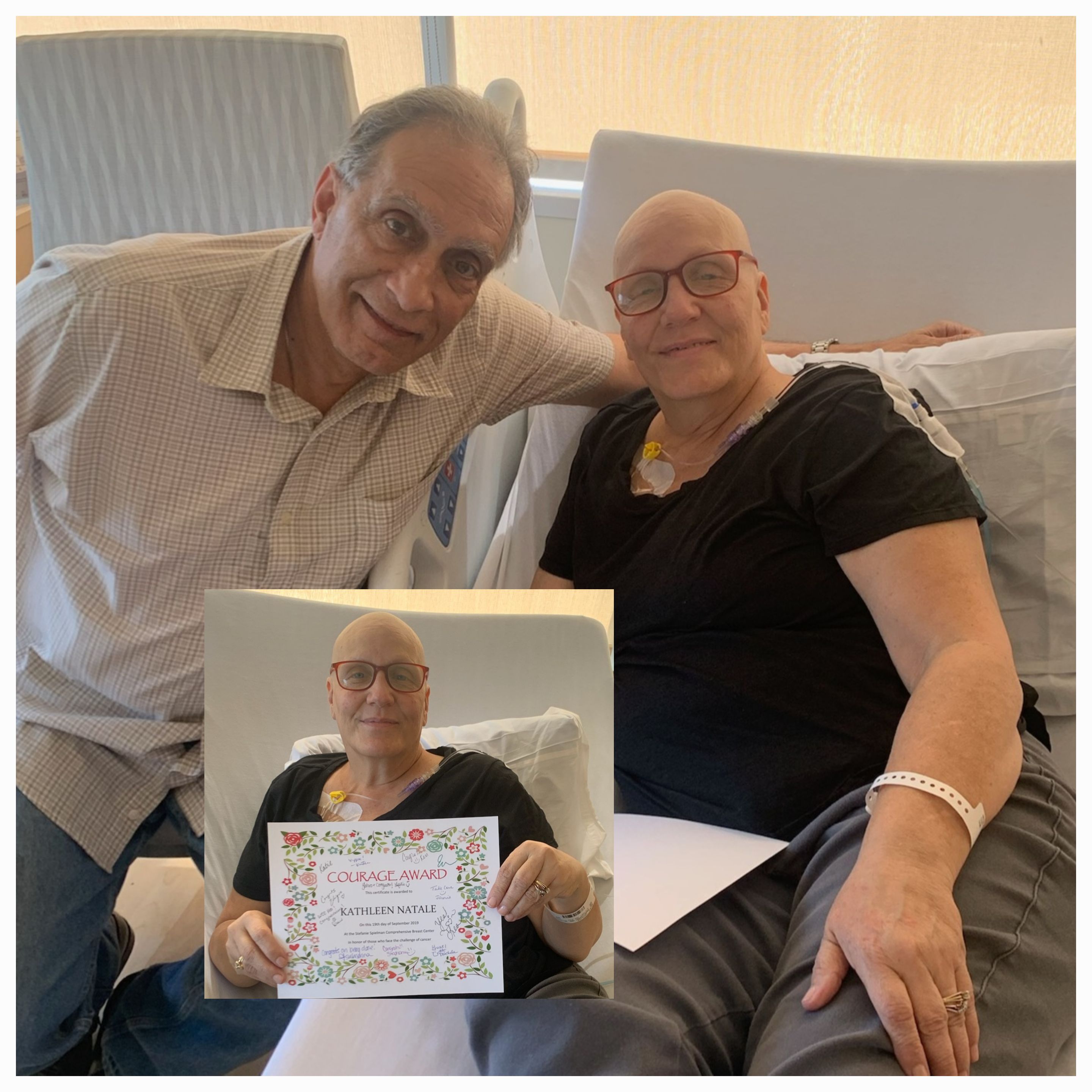

Let me share a little history about my family. I have six brothers and sisters. We have 26 nieces and nephews. That’s right, a huge and wonderful family. My mom and dad both suffered heart attacks and underwent open heart surgery at a young age. My mom had melanoma on her lower leg and throat cancer. My dad had prostate cancer and continues to have issues at age 92. My oldest brother Bob had thyroid cancer, diabetes, heart attack and open-heart surgery. My brother Tom had high blood pressure and diabetes and suffered 3 strokes. The first stroke he fully recovered but the last two made him fully dependent on my sister-in-law. Which by the way, she was a stay-at-home mom and had only recently re-entered the work force again. My sister Kathy, pictured with her family in this blog during different phases of her treatment plan, is just two years out from kidney cancer and breast cancer which were both discovered at the same time. She was a business owner at the time which she had to close due to the extent of her treatment. My sister Patricia’s son Isaac had lymphoma and underwent chemotherapy and radiation at age 22. I wasn’t in the insurance industry at the time so I could only help each of them as a nurse and family member. That was very frustrating to me because I saw the financial impact it had on all their individual situations. None of my family members had a critical illness policy at the time. I know from experience now that it would have change their lives. If you would like to avoid the financial struggles these situations can create with peace of mind, then reach out to me to learn more.

Follow Us On Social Media!

Another Great Way To Stay Connected

We love it when our clients follow us on social media. This is another great way to stay in touch and give updates on things going on in the market that can affect you. We also love sharing articles about health, life and finances. Click below to access our social media platforms.

Do you need a Consultation?

We can give you lots of advantages, from which you will surely benefit.

Do You Want To Review Plans Now?

No problem, just fill out our short form below:

Meraki Financial Group Copyright 2022 -- All Rights Reserved

Phone: (941)421-5889 Email: theresa@merakifinancialgrp.com